Automation debt is silently crippling organizations that invested heavily in workflow automation. The automatic way of solving operational inefficiency has become the norm. In the last 10 years, organizations have viciously embraced workflow automation software like Zapier, Make, Workato, Power Automate, and Monday.com automation to minimize labor and speed up performance. On paper, the outcomes are encouraging—less repetitive work, quicker approvals, and better coordination within cross-teams. However, in reality, in 2025, organizations were realizing that automation debt had become a silent source of tension.

The Digital Workplace Trends Report 2025 by Gartner has shown that almost 67% of automation projects introduced by the enterprises do not create the promised value during their initial year of implementation because of the complexity of maintaining such systems and the incompetence of integrating these systems. Instead of being time-saving, such workflows frequently bring in new delays, inconsistencies in data, and blind spots in operations. Teams waste hours of their lives trying to troubleshoot failed automations, fixing records that are not matching, or re-creating processes that have silently failed.

This is an increasing issue that is termed automation debt. Similar to software engineering assignments of technical debt, automation debt is accrued when workflows are written rapidly, without thinking of governance, documentation, or scalability. Every shortcut will seem innocent on its own. In the long run, though, these shortcuts add up to wobbly systems that sap productivity and portray automation as unreliable in the first place.

This trend is repeated in industries at Creative Bits. It is not the lack of automation-hygiene, it is the lack of automation as a concept. Knowing how automation debt is created, the ability to identify it at the initial stages, and to manage it systematically has become one of the essential features of the organization that does not plan to automate its work but to corrupt it.

How Automation Debt Forms Inside Modern Organizations

The process of automation debt is mostly initiated with good intentions. Automation in teams is done to eliminate bottlenecks, to respond more quickly to customers, or to keep in line with the growth. Nonetheless, decisions regarding automation are usually made in silos as organizations grow. The marketing creates automations in HubSpot, sales layers in Salesforce, operations integrations in Monday.com, and finance integrations in QuickBooks or NetSuite; each is localized to optimize, but globally integrated in a misaligned manner.

Tool sprawl that is not architecturally controlled is a significant cause of automation debt. According to the State of Automation Report 2024 by Workato, it is shown that automation failures are generally much more frequent in organizations with more than ten integrated tools because of overlapping logic and undocumented dependencies. With every new automation, the number of possible failure points grows, but not many teams have a centralized perspective of the interaction of these workflows.

Lack of clear ownership and documentation is also another sensitive initiator of automation debt. There are many cases when automations are constructed by the very people who change jobs or quit the company. When this occurs, workflow processes keep running with no one having a clear idea of why and what they are all about. According to the Digital Operations Survey 2024 by McKinsey, the workflow lacks a single team that can take ownership of the entire workflow, which is why 41% of the automation incidents remain longer than required.

With time, organizations start to offset brittle automations with handover. Workers repeat results, transfer the data to spreadsheets, or bypass the systems. These are classic symptoms of automation debt accumulating. This silent regression is the most obvious indicator that automation debt has already set in.

The Hidden Costs of Automation Debt on Your Bottom Line

Largely, the most perilous feature of automation debt is that most of the costs are hardly recorded in the usual financial indicators. Automation failure takes time to diminish performance as opposed to system outages. Here, teams lose minutes and hours there without understanding that automation debt is the root of the problem.

According to Automation Index 2025 (Zapier), half to a quarter of automation time is spent by teams with undocumented or barely managed workflows, troubleshooting, rather than performing value-creating work. This time wastage adds up per team, making automation debt an overall productivity sink rather than the efficiency booster it was meant to be.

Automation debt also causes data integrity to suffer. Asynchronous workflow leads to record duplication, inconsistent statuses, and unreliable dashboards. This is especially perilous to the leadership teams that can only use real-time insights. According to the Survey of Data Management and Automation 2024 by Forrester, it was discovered that organizations that do not govern their automations were twice as likely to make decisions using incorrect data.

In regulated settings, automation debt results in compliance risk. The IBM AI and Automation Governance Brief 2024 emphasizes that undocumented automations are becoming a more frequent cause of failure in audit purposes, as the decision being made cannot be documented or justified. At such instances, automation debt not only causes an efficiency decrease, but it leaves the organization vulnerable to legal and reputational damage.

5 Warning Signs Your Automation Debt Needs Immediate Attention

Automation debt does not tend to come screaming into view. Rather, it manifests itself in the form of minor signs of behavior and functioning. One of the first indications is the invisible friction—something that technically works but is made to take more time than it should because of additional checks, retries, or clarifications. Trust is already destroyed when employees start doubting the output of automation.

Workflow opacity is another indicator of warning. When teams find it hard to describe what an automation is, why it is there, and what systems it interacts with, that workflow has become a liability. According to a study conducted by the Atlassian Future of Work Report 2024, the reason behind the future of work is a lack of process visibility, which is one of the most powerful indicators of inefficiency in a distributed team.

However, frequent API throttling, slow triggers, or half-complete sync failures are indicative that the workflows were not scaled. According to the Power Platform Governance Report 2024 issued by Microsoft, low-code automations often deteriorate with higher volumes of transactions in the case of a lack of governance.

Once the teams do not have to improve workflows because they are afraid that some other aspect will fail, automation debt has become an organizational limitation instead of a technical one.

Here are the 5 key warning signs to watch for:

1) Invisible friction — Workflows technically work but require manual checks, retries, or clarifications.

2) Workflow opacity — Teams cannot explain what an automation does or why it exists.

3) Performance degradation — API throttling, slow triggers, and incomplete syncs become common.

4) Fear of change — Teams avoid improving workflows because they might break something else.

5) Manual workarounds — Employees bypass automations with spreadsheets and manual data entry.

How to Eliminate Automation Debt: A Systematic Approach

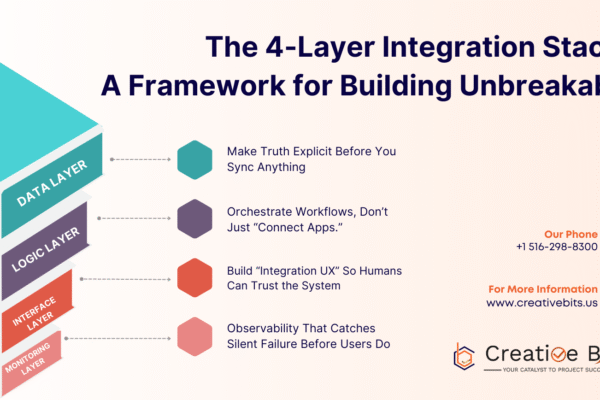

Escaping automation debt requires a mental shift. Well-performing organizations consider automation as a type of infrastructure and not a single implementation. The first step is visibility. All automation needs to be listed, recorded, and associated with a specific business outcome. Creative Bits acknowledges that there should be a central repository of automation, which will record triggers, dependencies, ownership, and paths to failure.

It is also important to perform refactoring regularly. Gartner advises having planned automation reviews of business-critical workflows at least twice a year in order to remain relevant and perform. Refactoring tends to simplify complexity in terms of workflow redundancy and simplifying logic.

The ultimate protection against automation debt is given by governance. According to Workato, when organizations have established automation governance frameworks, ROI on investments in automation can be as high as 55%. Governance does not drag teams to a crawl; it eliminates rework, errors, and automation scramble.

Above all, automation hygiene maintains human presence in the circle. Dashboards, alerts, and audit logs assist in making sure that problems are exposed and can be fixed before they become bigger failures.

Key steps to eliminate automation debt:

- Create a centralized automation repository documenting all workflows

- Schedule bi-annual automation reviews for business-critical processes

- Establish clear ownership for every automated workflow

- Implement governance frameworks with approval processes

- Set up monitoring dashboards and failure alerts

- Document dependencies and failure paths for each automation

Fixing Your Automation Debt—The Creative Bits Way

Automation debt is not unavoidable, but it is getting more widespread. Companies that automate without control end up being limited by the very systems that are supposed to speed up the businesses. The fate of automation will not be in 2025: whether it will be successful or not depends not on the tools, but on the approach.

At Creative Bits, workflow architecture and not wiring is the design of automation. We audit, refactor, and govern automation ecosystems in a way that they scale cleanly with the business. We do not simply aim to ensure that workflows run but that they do so resiliently, in an explainable manner, and in line with actual operational results.

When your automation debt makes workflows harder to handle than the process they were meant to replace, it is time to revert.

CONNECT WITH US to eliminate automation debt and restore confidence in your workflow systems.

monday.com Services

monday.com Services